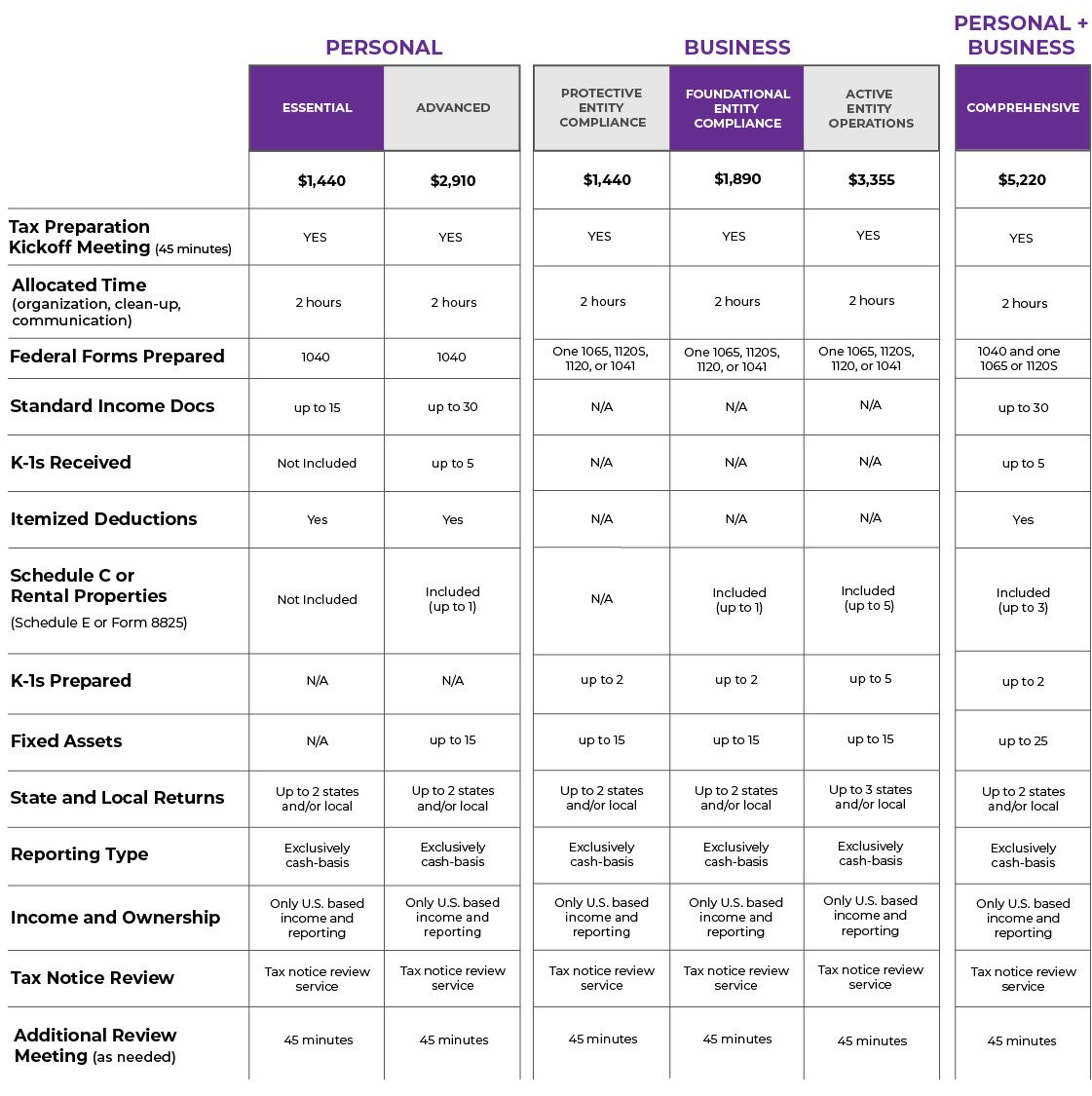

TAX PACKAGE OFFERINGS

Kindly note: If the scope of your tax preparation extends beyond the package, additional fees may apply.

PACKAGE DETAILS

Essential Package

Perfect For: Individuals and families with straightforward tax situations who value professional expertise without unnecessary extras.

This package is ideal for those with simple income sources, such as W-2 wages or basic investment income, and who don’t require additional forms like K-1s or business-related filings. It’s a great option for those new to tax preparation services or looking for a cost-effective yet reliable solution to ensure their taxes are prepared accurately and on time.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | 1040 |

| Standard Income Docs | up to 15 |

| K-1s Received | ✗ |

| Itemized Deductions | Yes |

| Schedule C or Rental Properties (Schedule E or Form 8825) | ✗ |

| K-1s Prepared | N/A |

| Fixed Assets | N/A |

| State and Local Returns | Up to 2 states and/or local |

| Reporting Type | Exclusively cash-basis |

| Income and Ownership | Single Income Source |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |

Advanced Package

Perfect For: Self-employed professionals, landlords, and individuals with moderately complex financial situations who need more than just basic tax preparation.

This package is designed for those with multiple income streams, including small business or rental property income, or investments that generate K-1s. It’s also a great fit for entrepreneurs and gig workers who need specialized forms, such as Schedule C for self-employment or Schedule E for rental properties, but don’t require a full corporate or partnership return.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | 1040 |

| Standard Income Docs | up to 30 |

| K-1s Received | up to 5 |

| Itemized Deductions | Yes |

| Schedule C or Rental Properties (Schedule E or Form 8825) | up to 1 |

| K-1s Prepared | N/A |

| Fixed Assets | up to 15 |

| State and Local Returns | Up to 2 states and/or local |

| Reporting Type | Individual |

| Income and Ownership | Only U.S. based income and reporting |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |

Protective Entity Compliance

Perfect For: Businesses or estates with minimal or no financial activity but a federal tax filing requirement.

Ideal for entities that need simple compliance with federal and state tax regulations.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | One 1065, 1120S, 1120, or 1041 |

| Standard Income Docs | N/A |

| K-1s Received | N/A |

| Itemized Deductions | N/A |

| Schedule C or Rental Properties (Schedule E or Form 8825) | N/A |

| K-1s Prepared | up to 2 |

| Fixed Assets | up to 15 |

| State and Local Returns | Up to 2 states and/or local |

| Reporting Type | Exclusively cash-basis |

| Income and Ownership | Only U.S. based income and reporting |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |

Foundational Entity Compliance

Perfect For: Businesses or estates with minimal or no financial activity but a federal tax filing requirement.

Ideal for entities that need simple compliance with federal and state tax regulations.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | One 1065, 1120S, 1120, or 1041 |

| Standard Income Docs | N/A |

| K-1s Received | N/A |

| Itemized Deductions | N/A |

| Schedule C or Rental Properties (Schedule E or Form 8825) | up to 1 |

| K-1s Prepared | up to 2 |

| Fixed Assets | up to 15 |

| State and Local Returns | Up to 2 states and/or local |

| Reporting Type | Exclusively cash-basis |

| Income and Ownership | Only U.S. based income and reporting |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |

Active Entity Operations

Perfect For: Small to medium-sized businesses or estates with active financial operations.

Designed for entities managing rental properties or multiple stakeholders, focusing exclusively on domestic activity.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | One 1065, 1120S, 1120, or 1041 |

| Standard Income Docs | N/A |

| K-1s Received | N/A |

| Itemized Deductions | N/A |

| Schedule C or Rental Properties (Schedule E or Form 8825) | up to 5 |

| K-1s Prepared | up to 5 |

| Fixed Assets | up to 15 |

| State and Local Returns | Up to 3 states and/or local |

| Reporting Type | Exclusively cash-basis |

| Income and Ownership | Only U.S. based income and reporting |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |

Comprehensive

Perfect For: Business owners, partners, and high-income individuals with advanced tax needs who require

comprehensive support.

This package is tailored for those managing business entities, such as S-Corporations or partnerships, and needs both individual and business returns prepared seamlessly. It’s an excellent choice for entrepreneurs or investors with multiple K-1s, rental properties, or self-employed income who want to maximize their tax savings while ensuring compliance with complex tax laws.

| Included | |

|---|---|

| Tax Preparation Kickoff Meeting (45 minutes) | ✓ |

| Additional Time (organization, clean-up, communication) | 2 hours |

| Federal Forms Prepared | 1040 and one 1065 or 1120S |

| Standard Income Docs | up to 30 |

| K-1s Received | up to 5 |

| Itemized Deductions | ✓ |

| Schedule C or Rental Properties (Schedule E or Form 8825) | up to 3 |

| K-1s Prepared | up to 2 |

| Fixed Assets | up to 25 |

| State and Local Returns | Up to 2 states and/or local |

| Reporting Type | Exclusively cash-basis |

| Income and Ownership | Only U.S. based income and reporting |

| Tax Notice Review | ✓ |

| Additional Review Meeting (as needed) | 45 minutes |